O Bitcoin Halving is approaching quickly, with less than 2,900 blocks left to go. miner rewards are cut in half. This event, scheduled to take place in April, is significant because Bitcoin Price could enjoy a parabolic move upwards after it occurs.

Bitcoin Halving Set for April 19

Data from Coinwarz shows that the Bitcoin Halving is scheduled to take place on April 19 in Block 840,000. This projection is based on current average blocking timemeaning the halving could occur a little before or some time after April 19th. However, the main focus remains that miners’ supply will be cut in half.

The Halving event is a deflationary measure that Bitcoin Founder Satoshi Nakamoto, encoded in the core cryptography and occurs every 210,000 blocks. Three halving events have occurred since the Genesis Block in 2009, when the first block of Bitcoin was mined. The first was on November 28, 2012, when miner rewards were reduced from 50 BTC to 25 BTC.

The next halving event occurred on July 9, 2016, cutting Miners’ rewards to 12.5 BTC. The third took place on May 11, 2020, reducing the reward to 6.25 BTC. Now, miner rewards will be cut in half again, bringing them down to 3,125 BTC.

This reward is the amount of BTC that miners receive for validating each block of new transactions on the blockchain. Although this event primarily affects miners, the crypto community monitors it closely due to the cascading effects it could have on the market. Bitcoin Supply it comes through the rewards of these miners, and a reduction in these usually increases the value of Bitcoin.

Bitcoin’s Performance After Each Halving

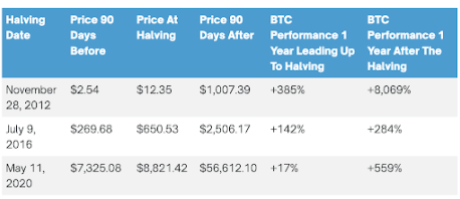

Historically, halving has always led to an appreciation in the price of Bitcoin. Ninety days after first half On November 28, 2012, the price of Bitcoin increased to $1,000 from $12 at the time of the halving. Subsequently, the price of Bitcoin saw a gain of over 8,000% a year after the halving.

Source: MilkRoad

This parabolic price increase also occurred after the second and third halving events, with the price of Bitcoin rising from $650 and $8,821 (at the time of the halving) to $2,506 and $56,612 (90 days after the halving) in 2016 and 2020, respectively. Bitcoin also gained 284% and 559% a year after the event.

This time is not expected to be any different like Bitcoin is again. foreseen experience a large upward movement after April. This bullish sentiment is further strengthened by Bitcoin demandwhich continued to soar in the face of decreasing supply.

At the time of writing, Bitcoin is trading at around $70,400, an increase in the last 24 hours, according to data from CoinMarketCap.

BTC price struggles ahead of halving | Source: BTCUSD on Tradingview.com

Featured image from 99Bitcoins, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC’s opinion on buying, selling or holding any investments and, naturally, investing carries risks. We advise that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.