After a week of net outflows, the Bitcoin ETF spot market has rebounded with impressive net inflows this week, highlighting investors’ growing confidence in Bitcoin and its associated financial products. This week’s market activities showed a notable reversal from the previous week 5-day net exit streakwith Tuesday witnessing a substantial net inflow of $480 million, followed by $243.5 million on Wednesday.

Yesterday’s resurgence in investor interest was notably driven by Blackrock’s massive $323.8 million inflow, effectively offsetting Grayscale GBTC’s $299.8 million outflow. Additionally, Ark Invest’s ARKB reported its best day yet with $200 million in inflows, despite Fidelity experiencing its worst day with just $1.5 million in outflows. However, Fidelity managed to recover with significant inflows of $261 million and $279 million on Monday and Tuesday, respectively.

Yesterday’s ETF flows were positive at $243.5 million.

Blackrock finally woke up again with $323.8 million canceling completely $GBTCoutflows of US$299.8 million.

Ark had its best day with $200 million. Fidelity had its worst day with $1.5 million.

Price dumped in… pic.twitter.com/LLChkITN7q

– WhalePanda (@WhalePanda) March 28, 2024

1% Down, 99% Up for Bitcoin ETFs

However, according to Matt Hougan, Bitwise’s chief investment officer (CIO), this is just the beginning of what’s to come in the coming months. Hougan’s comment, part of your weekly memo for investment professionals, sheds light on current market dynamics and the colossal potential that lies ahead. “1% down; 99% remaining,” wrote Hougan, highlighting the nascent yet promising journey of Bitcoin ETFs.

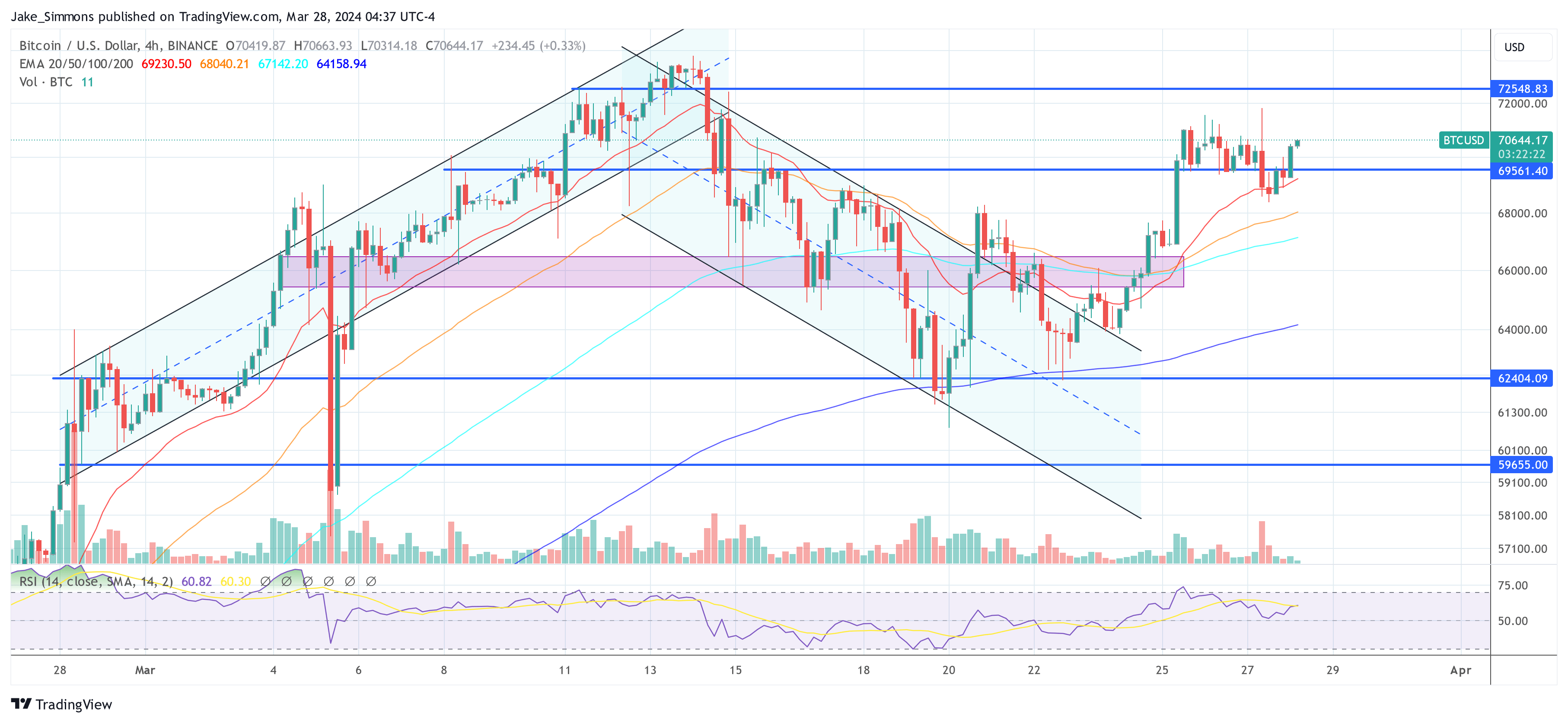

Lately, the market has been characterized by its volatility, with the price of Bitcoin fluctuating between US$60,000 and US$70,000. Hougan advises a calm, long-term outlook amid this fluctuation, especially as the industry anticipates upcoming Bitcoin halved around April 20th, the approval of Bitcoin ETFs on national account platforms, and the conclusion soon due diligence by various investment committees.

Despite Bitcoin’s current price sideways movement, Hougan remains optimistic about its long-term trajectory. “Bitcoin is in a bull market,” he says, noting an increase of almost 300% in the last 15 months. The launch of spot Bitcoin ETFs in January marked a significant milestone, opening the Bitcoin market to investment professionals on an unprecedented scale.

Hougan’s analysis points to a profound shift as global wealth managers, who collectively control more than $100 billion, begin to explore investments in “digital gold.” He suggests that even a conservative allocation of 1% of their portfolios to Bitcoin could result in approximately $1 trillion in inflows into the space.

This perspective is supported by historical data showing that even a 2.5% allocation to Bitcoin has improved the risk-adjusted returns of traditional 60/40 portfolios in every three-year period of Bitcoin’s history.

The recent inflows into Bitcoin ETFs, while impressive, are seen by Hougan as just the start of a much larger movement. “We are all excited about the $12 billion that has been funneled into ETFs since January. And it’s exciting: collectively the most successful ETF launch ever. But imagine that global wealth managers allocate just 1% of their portfolios to bitcoin on average,” Hougan elaborates, emphasizing the scale of potential growth that awaits the cryptocurrency market. He concludes:

Think about the implications. (…) A general allocation of 1% would mean about 1 trillion dollars in flows into space. Against this, 12 billion dollars is just an initial payment. 1% down, 99% remaining.

At press time, BTC traded at $70,644.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC’s opinion on buying, selling or holding any investments and, naturally, investing carries risks. We advise that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.