O Ethereum price didn’t exactly live up to its promise as the month went on, despite a stellar start to the month. While this bearish pressure has been widespread across the overall cryptocurrency market, regulatory uncertainty has been an additional concern for ETH, triggering negative sentiment around the “king of altcoins.”

Interestingly, the latest on-chain revelation shows that a substantial amount of Ethereum has hit exchanges so far in March, suggesting that investors may be losing confidence in the cryptocurrency’s long-term promise.

Are Investors Losing Confidence in Ethereum?

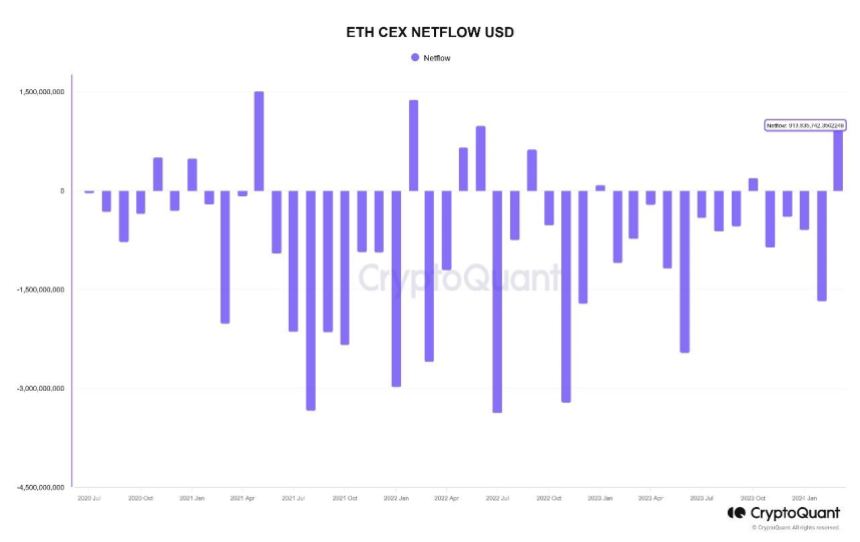

According to data from CryptoQuant, more than $913 million has been recorded in net ETH transfers to centralized exchanges so far in March. This information on the network was revealed through a quick post on the data analysis platform.

This net movement of funds represents the largest volume of Ethereum transferred to centralized exchanges in a single month since June 2022. Although the end of March is still a week away, this exchange flow appears to be a complete deviation from the pattern seen in recent months .

Chart showing total monthly netflow of ETH on centralized exchanges | Sources: CryptoQuant

As shown in the chart above, October 2023 was the last time cryptocurrency exchanges witnessed positive net inflow. It is worth noting that there was a significant movement of Ethereum tokens away from centralized platforms in the subsequent months until this month.

Meanwhile, a separate piece of data has surfaced that supports the mass exodus of ETH to centralized exchanges. Popular Crypto Analyst Ali Martinez revealed in X Nearly 420,000 Ethereum tokens (equivalent to $1.47 billion) have been transferred to cryptocurrency exchanges over the past three weeks.

The flow of large amounts of cryptocurrencies to centralized exchanges is often considered a bearish signal as it may be an indication that investors may be willing to sell their assets. Ultimately, this could put downward pressure on the price of the cryptocurrency.

Substantial movements of funds to trading platforms could also represent a change in investor sentiment. It could be a sign that investors are losing faith in a certain asset (ETH, in this case).

Furthermore, recent regulatory headwinds surrounding Ethereum specifically accentuate this hypothesis. According to latest reportThe United States Securities and Exchange Commission is considering an investigation into classifying the ETH token as a security.

Ethereum Price

At the time of this writing, the Ethereum Token is valued at $3,343, reflecting a 4% price drop in the last 4 hours. According to data from CoinGecko, ETH fell 11% last week.

Ethereum loses the $3,400 level again on the daily timeframe | Source: ETHUSDT chart on TradingView

Featured image from Unsplash, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent NewsBTC’s opinion on buying, selling or holding any investments and, naturally, investing carries risks. We advise that you conduct your own research before making any investment decisions. Use the information provided on this website at your own risk.